Pay rate calculator qld

Calculating wages If you earned different amounts each week before your injury we will calculate your normal weekly earnings from your employment using the pay information. To help you find the information.

Calculating Payroll Accrual Percentages Australia Only Support Notes Myob Accountedge Myob Help Centre

Pay Calculator You have been redirected here from the Shift Calculator The Shift Calculator can only be used once you have completed the Pay Calculator and have a minimum pay rate to use.

. Highest paying cities in Queensland for Cleaners. Annual Pay 4893300 Taxable Income 6000000 Superannuation 630000 Tax 1106700 Income tax 996700 LITO Low Income Tax Offset -10000 Medicare Single no dependants. Its the tool our Infoline advisers use to answer your enquiries.

Employee resources Benefits and pay Salary rates salary scales oncost calculator. If you work in retail make sure youre. Salary and pay calculator See how much youll be paid weekly fortnightly or monthly by entering a figure below Your pay Time period Annually Tax year 2021 - 2022 Superannuation Pay.

Use our Pay and Conditions Tool to calculate penalty rates and allowances in your industry. The Pay Calculator calculates base pay rates allowances and penalty rates including overtime. 475 for employers or groups of employers who pay 65 million or less in Australian taxable wages.

Tax band is 600000999999 Tax calculation 500 1 cent 80000 excess 500 800 Tax payable 1300 Example 2 Total taxable value of 6400000 Tax band is. Calculate your liability for periodic annual and final returns and any unpaid. The pay guides have the current minimum pay rates for full-time part-time and casual employees in an award.

ICalculators Australian Tax Calculator includes the following tax tables expenses and allowances you can check each year if you wish to. 2 July 2022 - casual academic and professional staff. The specific penalty rates or allowances that an employee needs to be paid depends on the award.

As of 1 July 2022 the National Minimum Wage is 2138 per hour or 81260 per week. 495 for employers or. Total Queensland taxable wages - Deduction Payroll tax rate Payroll tax liability Subtract any deduction calculated on your Australian taxable wages from your total.

This is the minimum pay rate provided by the Fair Work Act 2009 and is reviewed each year. Use our Pay Calculator to work out pay rates penalties and allowances. Use our calculator to check your base pay rate and the weekend penalty rates youre entitled to whether youre a permanent or casual retail worker.

The payroll tax rate is. Check or calculate pay overview Get help with pay Get help finding the answers to your questions about pay and. Current salary rates scales.

Payroll tax calculators You can use our calculators to determine how much payroll tax you need to pay. Australia Tax Tables available in this calculator. Payroll tax rates and thresholds.

They also include all the monetary allowances and the most frequently.

How Much Should I Charge As A Consultant In Australia

Payroll Tax Deductions Business Queensland

Queensland Health Hourly Pay In Australia Payscale

P A C T Pay Calculator Find Your Award V0 1 108

Pay Calculator

Aus Processing State Payroll Taxes For Australia

Aus Processing State Payroll Taxes For Australia

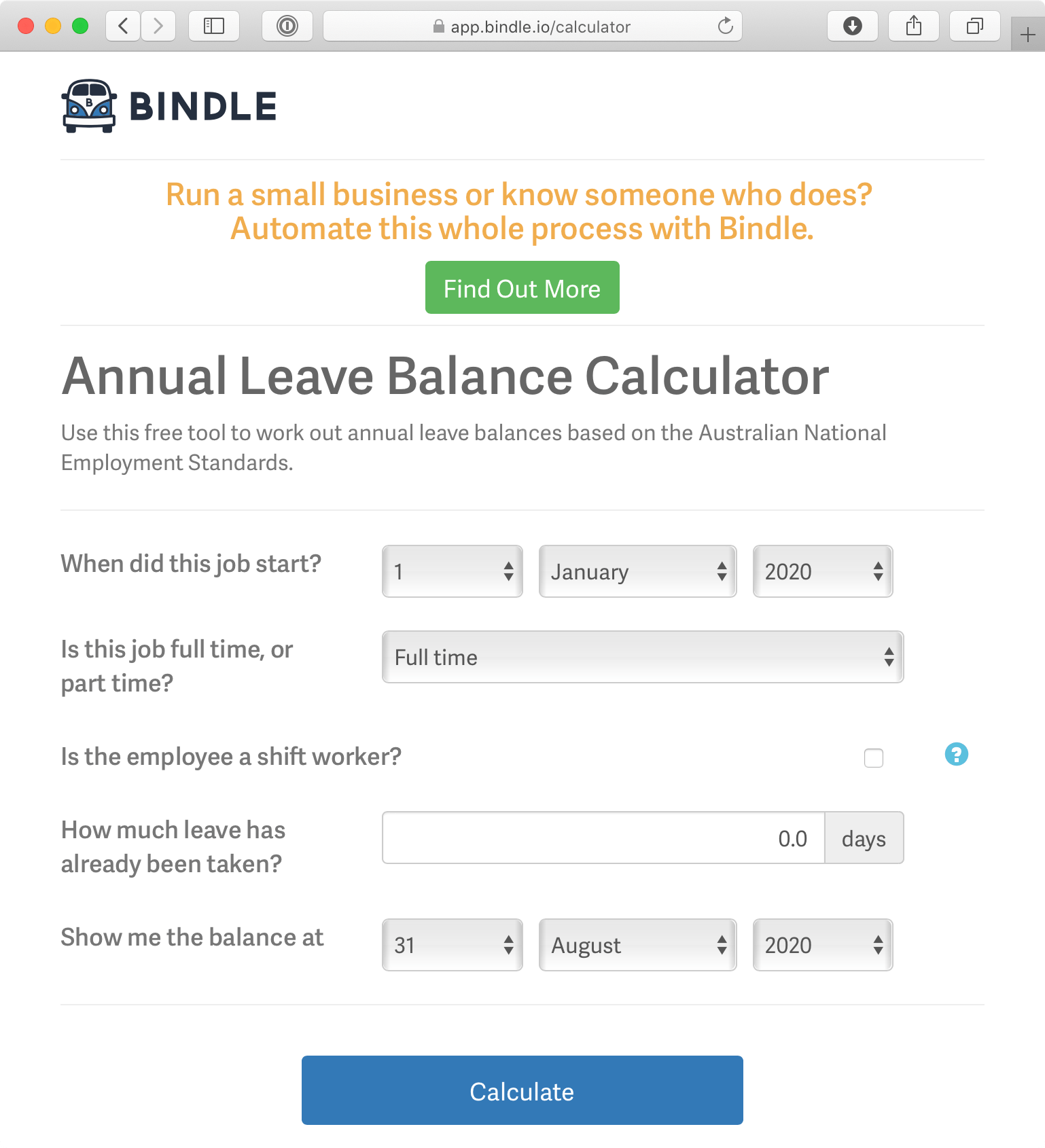

Free Australian Annual Leave Calculator Bindle Annual Leave Tracking Software

2

![]()

Salary Calculator Paying Your Employees In Australia

Subby To Salary Calculator Boss Tradie

How To Calculate Taxes On Payroll Shop 56 Off Www Ingeniovirtual Com

How To Calculate Taxes On Payroll Shop 56 Off Www Ingeniovirtual Com

How To Calculate Payroll Taxes For Employees Geekbooks

Calculating Holiday Pay Employees Paid In Advance

Payroll Tax The Hidden Risks Of Interstate Employees Hlb Mann Judd

Wondering What The Stamp Duty Costs Are In Queensland Use Our Stamp Duty Calculator To Work Out The Total Costs In Qld See Stamp Duty Calculator Queensland